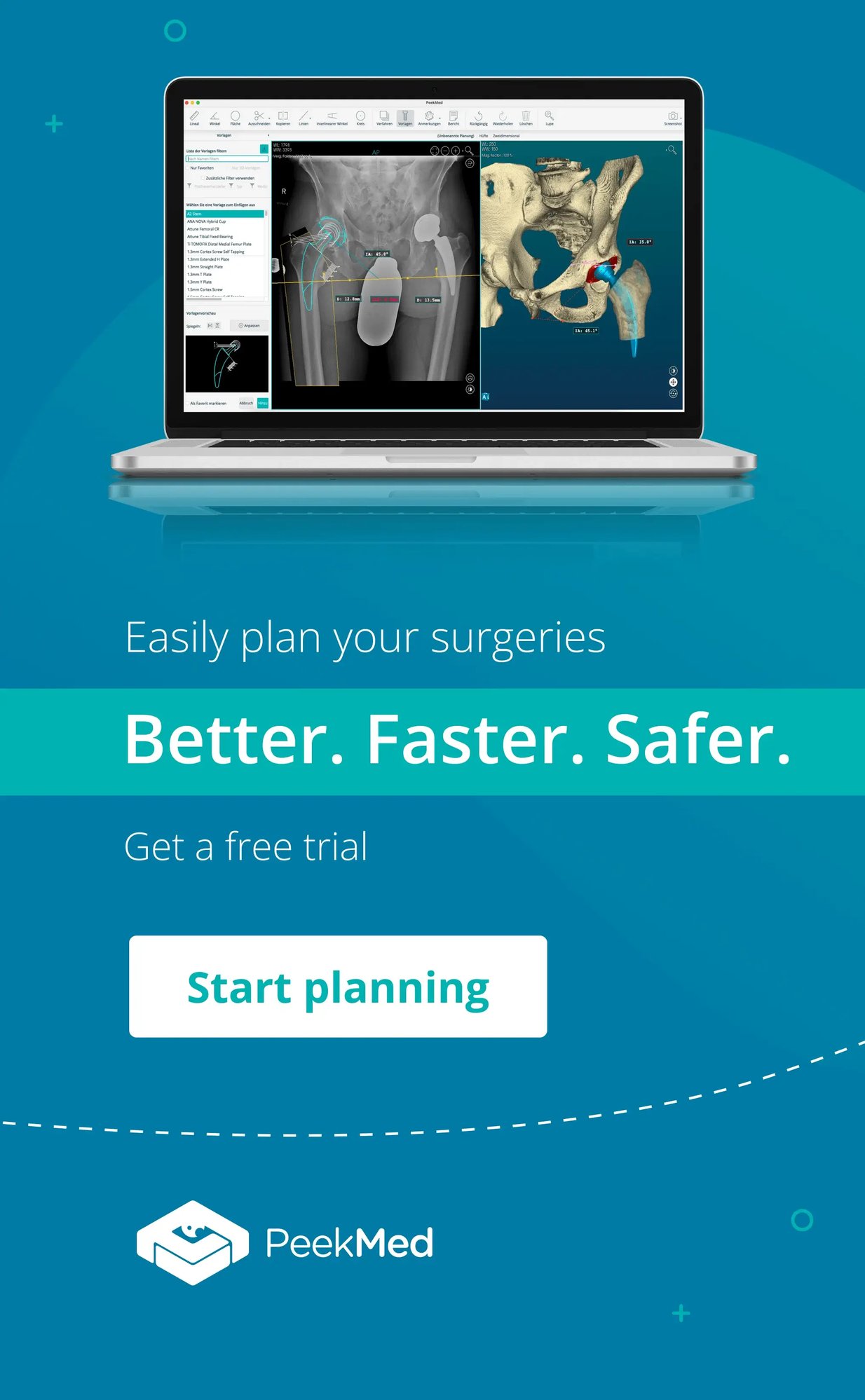

PeekMed

As technology advances, it brings transformative changes to every field, and the orthopedic robot industry is no exception. Orthopedics has seen significant innovations, from cutting-edge surgical instruments to advancements in outpatient surgery, enabling new approaches to clinical practice.

These technological and digital transformations have a substantial impact on Orthopedic Equipment Manufacturers (OEM).

To provide insight into the current state and future directions of technology in this field, we spoke with an expert in the industry: Todd Davis.

Todd Davis has a rich background, having worked with Zimmer (1987-2008), and later leading Biomet’s global knee business until Zimmer’s acquisition. He also served as President and General Manager of the Global Knee Business, managing the world’s largest orthopedic franchise valued at nearly $3 billion.

Since 2021, Todd has been an Independent Board Member at PeekMed. With 30 years of experience, Todd Davis offers a comprehensive perspective on the orthopedic field. In our discussion, he shared valuable insights on topics such as:

Robotic Surgery and the Orthopedic Industry: trends for the future

PeekMed (P): Todd, you have been working in the industry for over three decades now. This includes both orthopedic surgical instruments, implants, and much more. Did technology change the orthopedic market?

Todd Davis (T): Yes, technology had a huge impact on the orthopedic industry, allowing us to boost productivity and become more efficient.

While technology has always been a part of the orthopedic industry, it had typically been relegated to a small minority.

Examples of that have been surgical navigation which, in the 1990s, gained regional popularity in Australia and parts of Europe. Then, in the 2000s, patient-specific guides became popular in parts of the United States / North America.

With the introduction of robotics in the 2010s, you now see technology with global appeal and a huge incidence of orthopedic robotic surgery. Later, the robotic trend gained a huge dimension in 2013, when Stryker acquired Mako Surgical.

As of today, each of the Big 4 orthopedic companies – Zimmer Biomet, Stryker, DePuy Synthes, and Smith+Nephew – have launched their robotic platforms. Likewise, many mid-tier companies have introduced robotic capabilities.

Stryker has publicly announced that over 50% of all their primary knee procedures in the US are being done with Mako, their robotic arm. It is estimated that over 20% of all knee surgeries done in the US are performed with a robot, approaching 15% worldwide.

Aside from robotics, technological instruments used in orthopedic surgery also include artificial intelligence, virtual reality, and other sophisticated technologies.

All these are being developed and introduced for surgical use within the orthopedic landscape, which makes robotic surgery a huge tool for the future. Suffice it to say, technology is here to stay.

What can tech offer to the orthopedic Industry?

P: A lot has been done to bring implants and technology closer together. However, many key players in the industry are yet to trust its true capability. What benefits can technology offer the orthopedic industry that might yet be missing?

T: Technology can offer a lot more to the industry than what they are demanding right now. This might be because of a lack of awareness of what combining technology with orthopedic instruments and surgical tools can do for the industry.

Right now, the Orthopedic Equipment Manufacturers (OEM) have two big challenges:

- The overall cost of doing business;

- The pressure to utilize lower-cost imaging to drive their robots;

1. Cost of doing business: from ortho instruments to implants

The cost to serve that the OEMs are focused on today includes the cost of implant inventory management. That is the biggest cost of orthopedic surgery: the write-off of excess (overstocking) and obsolete inventory.

Through preoperative planning technologies, OEMs can align both the orthopedic instruments and implant needs with their customer. That's the massive advantage of preoperative planning: delivering a streamlined set of instruments and implants for surgeries that are aligned with inventory management systems. Thereby reducing the cost of doing business in the orthopedic field.

2. Imaging and Robotic Surgery: the quality trade-off of orthopedic surgical tools

The orthopedic industry players will also need to solve the fact that most of the robotic platforms utilize expensive imaging technology to create the plan that the robot will ultimately execute.

CAT scans and MRIs are both expensive and fall out of favor with payors.

Alternate modalities will have to be developed and deployed to provide the images that will create these robotic plans.

The use of X-rays would be hugely preferred by both surgeons and payors as they are the current standard of care and would not necessitate a change in their current workflow.

Short future of healthcare and Orthopedics

P: While we’ve been talking about orthopedic trends and technology for the future of orthopedics, what can we expect in the short term? As of today, is the orthopedic field changing?

T: The market is in constant change. That’s why innovative companies such as PeekMed are important: they are in constant search of an update developing the future today.

Right now, there have been two new recent trends in the orthopedic industry:

- Orthopedic Outpatient Surgery, specifically Total Joint Arthroplasty (TJA)

- Orthopedic Surgeons as owners of Ambulatory / Outpatient Surgery Centers (ASCs)

Both these trends have been increased by the COVID-19 pandemic.

These are very synergistic trends in outpatient orthopedic surgery, which forces surgeons to be focused on costs, the burden of implant inventory, instrument set storage, and cleaning, and the overall health of the patient preparing for outpatient TJA.

This might be the first time that implants’ costs directly impact the surgeon, as there is associated price pressure on a much smaller business.

Additionally, the smaller players, who are more willing to lower their implant price, have taken significant market share from the Big 4.

Most ASCs have fairly reduced storage space, limited clean room capability, and smaller operating rooms than the traditional hospital setting. This puts the burden on the OEMs to streamline their implant and instrument, delivery models.

The most efficient way to manage stocks and inventory is to have a preoperative plan with templated implant sizes, allowing the vendors to bring significantly fewer instruments and implants for each surgery.

Finally, while patients are generally getting younger, they are no healthier than the historic TJA patient. With the expectation to have these patients go home later the same day, the surgeons are looking for nutrition solutions to allow their patients to prepare better and recover faster after surgery.

P: On that note, what advice would you give to players in the healthcare industry?

T: As mentioned previously, the OEMs are going to continue to have to find ways to lower their cost to serve.

The trends of outpatient TJA and ASCs are only accelerating and will have the associated challenges highlighted above.

The OEMs are going to have to do business differently than they have for the past 4-5 decades.

Those differences will be building a business model that utilizes preoperative planning software to precisely determine the size of each implant required for each surgical patient.

OEMs will also have to partner with their surgeon customers to assist them in caring for the patients more holistically, being partner through the entire patient journey, likely including nutrition, postoperative pain management, and physical rehabilitation.